- Auto loan calc amortization how to#

- Auto loan calc amortization plus#

- Auto loan calc amortization free#

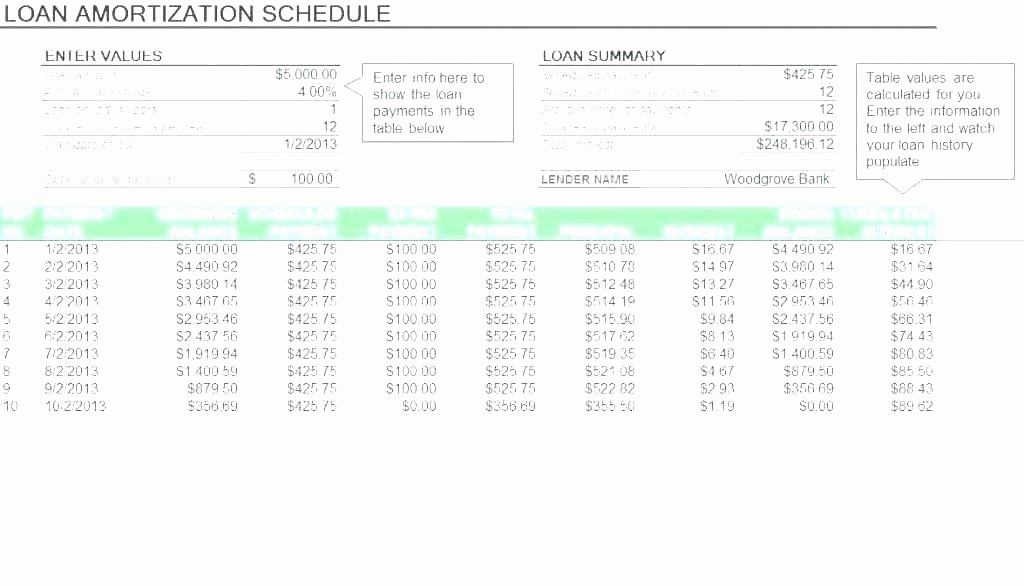

Free Checking Keep moving ahead with no minimum balance or monthly service fees slowing you down.The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies. The cookie is used to store the user consent for the cookies in the category "Performance". This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Other. The cookies is used to store the user consent for the cookies in the category "Necessary". The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Functional". The cookie is used to store the user consent for the cookies in the category "Analytics". These cookies ensure basic functionalities and security features of the website, anonymously. Necessary cookies are absolutely essential for the website to function properly. To get the total interest you simply deduct the principal amount from the total repayment amount.To get the total repayment amount multiplication is needed the monthly payment by the number of months where the loan is for.Use the monthly payment method (formula) to calculate the monthly payment. How is the interest rate for a car loan calculated? N = Total # of Months for the loan ( Years on the loan x 12) Example: The total cost for 5 year loan, with a principal of $25,000, To calculate the total loan cost of a vehicle loan use this formula: r = Monthly Interest Rate (in Decimal Form) =. How do you calculate total interest on a car loan? Finally,subtract the principal from the total amount you have to pay back to get the total interest amount. For the next part of the formula,or ( (1+r)n – 1),add 1 to the APR per month and then Determine the second part of the formula.Next,for the first part of the equation,or (r (1+r)n),add one to the interest rate per month. Determine the first part of the formula.This gives you the amount of interest charged on a monthly basis. Once you know how much you want to borrow and the interest rate that you need to apply,you can use a simple formula

Auto loan calc amortization how to#

How to calculate total interest on a car loan? That period of time could be four or five years for a car payment, or thirty years for a home mortgage. The most common example is a car or house payment where you borrow once, and then make the same payment every month for a fixed period of time. How many years is your car loan amortized for?Īmortization is when you pay off a loan over time with regular, equal payments.

Be sure to check with your lender before you make an early pay-off. They do this to make up for the money they’ll lose by not collecting the long-term interest on your loan. Paying off a car loan early can temporarily affect your credit score, but the major concern is prepayment penalties charged by the lender.

Auto loan calc amortization plus#

For car loans, APR is the rate you pay that accounts for your interest charges plus all other fees you have to pay to get your loan. How does Apr work on a car?ĪPR stands for “Annual Percentage Rate.” It is the annual rate of finance charge you pay for your loan or credit line. So, each and every payment that the borrower makes will lower their principal balance, which in turn will lower the amount of interest that accrues with the next installment. With a simple interest auto loan, interest accrues on a daily basis based on the outstanding balance (principal balance). It also lowers your car insurance payments, so you can use the savings to stash away for a rainy day, pay off other debt or invest. Paying off your loan sooner means it will eventually free up your monthly cash for other expenses when the loan is paid off. Is it better to pay off a car loan early? Your monthly payments are applied to both the principal of the loan and your interest charges that accrue. Are car loans amortized monthly?Īuto Loan and Simple Interest A loan that amortizes means that the principal is reduced over time, and requires monthly (or regular) payments. Industry standard used to be to amortize car loans over 60 months - five years - but as low interest rates settled in, payment periods began to stretch longer and longer to make monthly payments as low as possible. More than half of all new car loans are currently financed for 84 months - seven years - or longer.

0 kommentar(er)

0 kommentar(er)